June 2018

One common point of disagreement amongst opposing sides of a lost earnings case is future earnings, especially when the claimant has no meaningful earnings history. This typically occurs in personal injury cases in which the injured party is a child or an adolescent. Recently published data by the Board of Governors of the Federal Reserve System (“Federal Reserve”) provides data that may substantiate a claimant’s future lost earnings calculation.

The Federal Reserve publishes its Survey of Consumer Finances (“SCF”) every three years. The SCF is an interview survey of U.S. families that contains information about family incomes, net worth, credit use, and other financial outcomes. According to its most recent publication, the SCF was redesigned in 2016 to “stay up-to-date with new developments in family finances”. The redesign included, inter alia, a question regarding the highest level of education attained by the interview respondents’ (i.e., families’) parents. The level of education obtained by one’s parents is one measure of socioeconomic status that can be used to understand inter-generational economic mobility. Combining this new data/information with the respondent’s income levels allows one to examine whether a relationship between parental education and its child’s income level may exist.

Intergenerational economic mobility studies is a large and active area of research. Some studies indicate that (i) a child’s income level may be correlated to his/her parent’s income level, and (ii) a child’s likely education/skill level may be correlated to the parent’s education/skill level. The data contained in the most recent SCF indicates that higher levels of parental education are associated with higher incomes and wealth-holding for the respondent. The following chart (courtesy of the SCF, 2016) shows this conclusion graphically.

Median Income and Net Worth by Parental Educational Attainment, 2016

Additional data/information contained in the recent SCF includes the following:

“The typical family in which at least one of the respondent’s parents has a four-year college degree had a little more than double the income and wealth of families in which neither of the respondent’s parents had a high school diploma. However, the relationship between parental education and [respondent’s] income and wealth is not as strong as the relationship between a respondent’s own education and income and wealth. In 2016, the typical family headed by respondents with a college degree had over 3 times more income and almost 13 times more wealth than families headed by respondents without a high school diploma.”

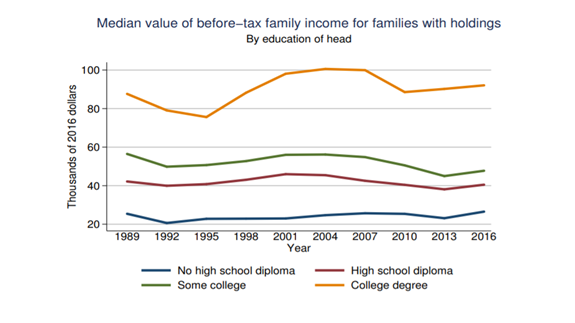

The above results for 2016 (related to the relationship between respondent’s own education and income) are similar going back in time. Specifically, the following graphic (courtesy of the SCF) indicates that historically earnings increase as education levels increase:

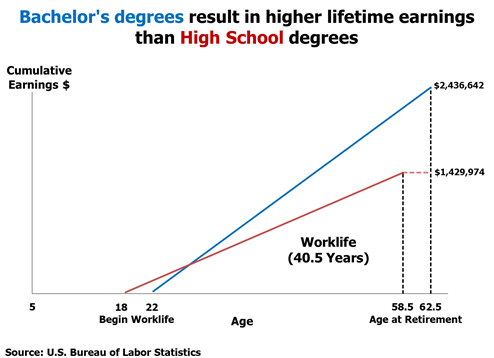

By combining the data/information described above with other publicly available data (e.g., U.S. Bureau of Labor Statistics), one may calculate future lost earnings of a claimant with no meaningful earnings history based on, inter alia, the claimant’s parent’s educational attainment. The following graphic illustrates a future lost earnings calculation (not yet discounted to present value) based on the data described above and other publicly available data. In this example, two different scenarios are provided: (i) the claimant’s highest level of education will be a high school degree (based on the assumption that the claimant’s parent’s highest level of education was a high school degree), and will start working at age 18, and (ii) the claimant’s highest level of education will be a Bachelors degree (based on the assumption that the claimant’s parent’s highest level of education was a Bachelors degree), and will start working at age 22. In this example, the claimant was approximately five years old at the time of the injury. On average, a Bachelors degree will generate approximately one million dollars more of income over a 40.5 year work life than a High School diploma.

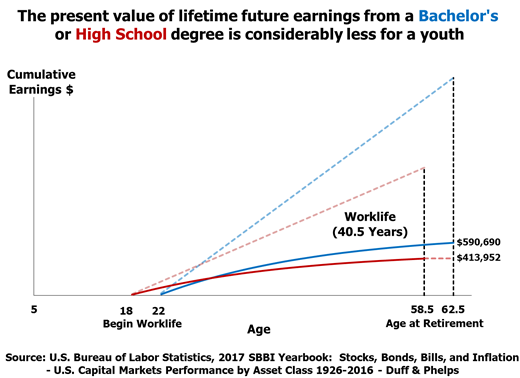

Notably, the present value of lifetime future earnings is less for a youth that has not yet started employment. Applying a blended discount rate of approximately 4.5% to the above example results in the following:

Fulcrum Inquiry regularly assesses damages in injury and employment matters, through both direct employment of expert and with our interactive settlement tool.