Summary of Valuation Approaches

There are four different types of valuation methods that can be used to value coin-operated laundry businesses, as follows:

- Asset-based valuation

The basic formula to use for this method is: The fair market value of a company’s assets less the fair market value of its liabilities = the fair market value of a company’s equity. - Income approach to value (capitalization of earnings)

This method is most the accurate for coin-operated laundry businesses, which usually have a constant growth of earnings. This method is equal to the cash flow projection for one year divided by the capitalization rate. - Income approach to value (discounted cash flow)

The value of equity utilizing this method is equal to the present value of free cash flows available to equity holders over the life of the business. - Market approach to value

This method utilizes market indications of value such as publicly traded comparable company stock as well as acquisitions of privately held coin-operated laundry businesses.

Description of the Industry

The coin-operated laundry industry is highly fragmented consisting mostly of individual owner and operators. There are no significant franchises operating at this time in the U.S. This industry falls into the SIC code of 7215 and NAICS Code of 812310 and has two major segments. The first segment consists of coin-operated laundry facilities located in retail space while the second segment consists of coin-operated laundry machines located in multi-unit apartment complexes. This second segment is often referred as route based. Coinmach is the largest U.S. company that primarily operates in this route based segment. Their clients include property management companies, colleges & universities as well as the U.S. military. According to The Coin Laundry Association (“CLA”) the industry experiences annual sales of approximately $5 Billion with about 35,000 locations in the U.S. CLA also reports that a single facility can generate cash flows at a level of $15,000 to $200,000 per year.

The coin-operated laundry industry is in the mature phase of the industry life cycle. Generally coin-operated laundry businesses are not currently experiencing high levels of revenue growth. The only exception to this is facilities located in areas that are experiencing large amounts of population growth coupled with increasing population density. The primary customers in this industry are home renters versus home owners. Areas with higher population density have a larger percentage of people that rent their home resulting in greater demand for coin-operated laundry facilities in these locations.

Coin-operated laundry businesses are poised to perform well in the face of the current economic recession that the U.S. faces. The U.S. recession has increased the percentage of people that rent their home which has in turn increased the demand for coin-operated laundry facilities. In addition, during recessions people are reluctant to purchase new laundry machines or have them repaired. These factors have contributed to increasing demand for coin-operated laundry facilities in the short term.

Industry Trends

There are a few trends that the coin-operated industry is experiencing. These trends include:

- Many new laundry facilities are utilizing smart card technology which requires the customers to put money on a card that they then swipe when they use a machine. This transaction process reduces the need for change machines and also helps to increase repeat business since the customer will likely use the facility until the money that they put on their card is used up.

- Many laundromats have themes to help bring in customers.

- Many laundromats have a play area for children. This feature has proven to be successful in attracting mothers that need to do their laundry with children in tow.

- Video games, televisions, snack bars and vending machines are all becoming more common in coin-operated laundry businesses.

Key Performance Metrics

There are a few different performance metrics utilized in the coin-operated laundry industry.

- Turns per day (TPD) also known as cycles per day – this metric is a measure of how often all machine are used each day. The CLA indicates that TPD for a facility ranges from 3 to 8 times per day with the national average being 5 times per day.

- Dryer income as a percentage of washer income – generally dryer income ranges from 40-60% of total washer income.

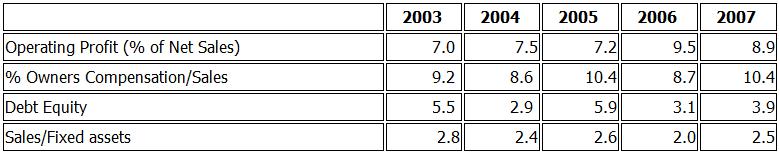

Financial Benchmark Statistics

Coin-operated laundry businesses are somewhat unique in that they have no inventory to manage and also have no receivables to collect. The following benchmarking data is based on studies from many coin-operated laundry businesses ranging from $50,000 to 10,000,000 in annual sales and represents median performance.

Industry Organizations and Publications

- Coin Laundry Association

- Coin Laundry News

- American Coin Op

Availability of Publicly Traded Guideline Firms

MAC-Gray Corp. is the only publicly traded coin-operated laundry businesses in the U.S. It has sales of approximately $364 million and an operating profit of nearly 6.5%. The company also has a forward looking Price/Earnings ratio of 29 and a Price/Cash flow multiple of 3.2. MAC-Gray has enjoyed nearly 20% growth in revenue over the last 5 years due to several acquisitions.

Availability of Purchase Transactions

According to one database that tracks coin-operated laundry company purchase transactions there have been 81 purchases of coin-operated laundry businesses in the U.S. since 2002. The size of these acquired companies range from $10,000 to $69,300,000 in annual sales. From 2002 to the present, the multiple of:

- Market value of invested capital to Net Sales (MVIC/Sales) ranged from 0.3 to 3.3 times

- MVIC to earnings before interest, taxes and depreciation (MVIC/EBITDA) ranged from 1.2 to 13.6 times.

This range of market multiples is too variant to be useful without further analysis. A proper value for the company that you are assessing should be based on the performance of the subject enterprise, compared to the performance of others in the same industry. Industry economic conditions also vary at different times, which obviously affect coin-operated laundry businesses as investment opportunities. Specific factors that are unique for each coin-operated laundry business must be considered. Some of these factors include:

- The duration of the lease and landlord/tenant relations

- The proximity of the facility to highly populated and high density residential areas

- The condition of the laundry equipment

- This history of the operation

- The competitive environment of the local area

Fulcrum Inquiry performs business appraisals for coin-operated laundry businesses (Laundromats) as well as other types of businesses.