Higher education can provide a host of benefits, including opportunities for increased earnings. In a typical lost earnings case, many expect that the more education the Plaintiff has or is expected to obtain, the more lost earnings Plaintiff will suffer (all other factors being equal). However, this may not always be the case. The ultimate financial impact of higher education to an individual will vary based on a number of factors.

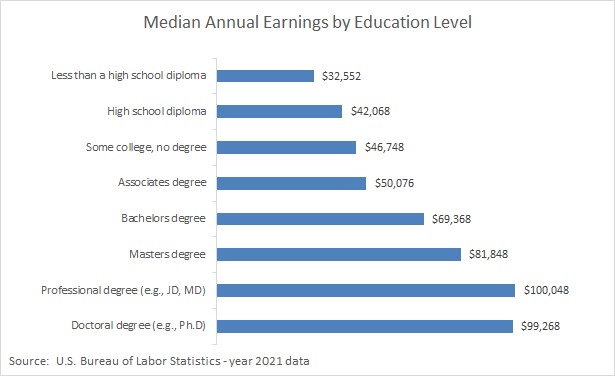

The following chart summarizes data published by the U.S. Bureau of Labor Statistics (“BLS”) which demonstrates that median earnings generally increase with higher education levels.

However, this pattern may not result in meaningful value of future earnings differences amongst different education levels when appropriately accounting for the following items:

1. Upfront investment cost of obtaining higher education

2. Opportunity cost of obtaining higher education – one forgoes the income he/she could have earned during the time obtaining higher education

3. Average expected worklife

4. A proper discount rate – future amounts are reduced to present value

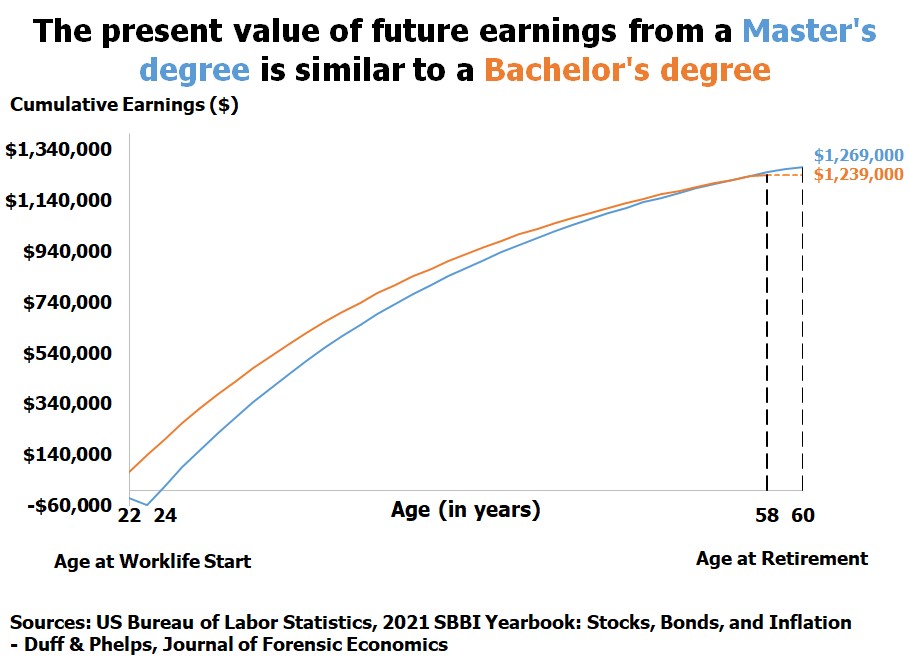

The following provides a simplified example of how different education levels might impact a lost earnings calculation:

A college student is severely injured and rendered unable to work. There is evidence that she intended to pursue a Master’s degree after college. Plaintiff’s lawyers have asserted that she is entitled to significantly more lost earnings because “statistics show” that those with a Master’s degree earn more.

In evaluating Plaintiff’s claim, one must appropriately account for how the different costs and benefits track over Plaintiff’s expected worklife. A present value discount recognizes that a reasonable rate of return could be earned by investing the up-front monetary award over the damage period. The timing of individual components is important when applying the present value discount. For instance:

1. While Plaintiff is expected to earn more, the cost of her additional education must be offset. This additional investment occurs at the beginning of the endeavor, while the earnings benefit occurs subsequently. Accordingly, the present value impact of the education cost is proportionately higher.

2. During the time attending the Master’s program, Plaintiff would forgo the income she could have earned. Again, this occurs in the earliest periods, while the earnings benefit occurs subsequently. Accordingly, the present value impact of the foregone earnings is proportionately higher.

3. Plaintiff’s average expected worklife may change based on the different factors.

When applying (i) the annual median incomes for a Master’s and a Bachelor’s degree described above, (ii) an average annual cost of a Master’s program of $30,000 (incurred for two years), (iii) a median worklife expectancy of 36.5 years at the time of obtaining the degrees, and (iv) a 5% net discount rate, a similar outcome occurs despite the educational differences:

In this example, any earnings boost from the additional education is largely consumed by the cost of the education and the timing of the earnings differentials between a Bachelor’s and a Master’s degree. When such appropriate statistics are ignored, there is risk of an impermissible windfall in a Plaintiff’s lost earnings claim.

Fulcrum Inquiry assists lawyers with economic damages associated with injury and employment matters, through both direct employment of experts and with our interactive settlement tool.