February 2019

A recent survey of 306 accounting and finance professionals, including more than 200 controllers from the U.S., Canada, Europe, Asia, Africa and Latin America, describes that almost two-thirds have experienced pressure to “cook the books”.

The survey was conducted by Dimensional Research and sponsored by FloQast, an entity which provides management software for corporate accounting departments. The survey included the following question: “Have you ever felt pressure – either directly or indirectly – for financial reporting to be less accurate in order to produce a better view of company performance?”

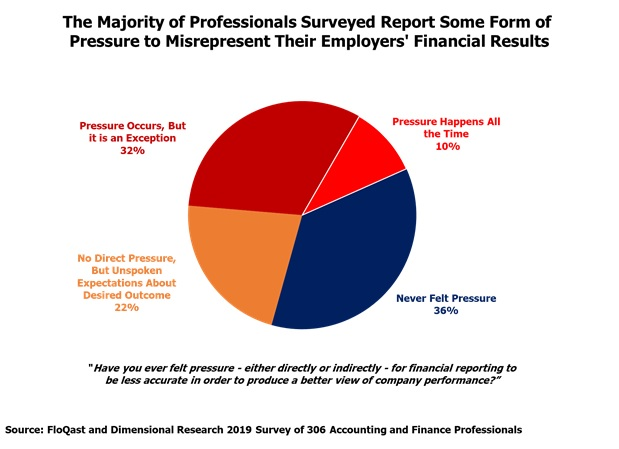

The report describes how “Alarmingly, this study shows that this kind of pressure is all too common….a worrying 10% report that this is a regular part of their job.” Overall, responses were as follows, with only 36% reporting no pressure, while 64% indicated some level of pressure:

Interestingly, the question posed in the survey was specifically focused on pressure to manufacture improved results. Such pressure might occur when the company is looking to acquire financing, meet loan covenants, increase metrics used for bonus calculations, or justify a higher business valuation to a potential buyer. However, there are also instances where finance and accounting professionals might feel pressure to report results that understate performance. This pressure might exist for tax reporting, justifying a loan workout, calculating a buyout provision, or reporting profits to an absentee or minority shareholder. Regardless of whether the pressure is to inflate earnings or decrease earnings, these survey results suggest that those relying on financial reports should be on the lookout for unexpected trends or other red flags or indicia of fraudulent reporting. In many cases a forensic accountant can provide the appropriate due diligence or investigation when misreporting is suspected.

Fulcrum Inquiry regularly performs forensic accounting services.