Damage experts often disagree regarding the appropriate discount rate in a lost earnings claim, a factor that can make a meaningful difference in the economic damages conclusion. A recent article, “An Interactive Settlement Tool Streamlines Negotiations in Lost Earnings Matters“, demonstrates the significance of the applied rate on damages. A low discount rate benefits the plaintiff as it results in a higher ultimate damages result (all else equal). Notably, certain commonly applied methods actually provide a windfall to plaintiffs.

Every few years, the Journal of Forensic Economics (JFE) publishes the results of its survey of National Association of Forensic Economics (NAFE) members regarding their methods, estimates, and perspectives on lost earnings calculations. One of the areas of inquiry is present value discount rates. In the most recent JFE survey, published in early 2018, the following question is posed:

When discounting, I generally use (select one):

| A net discount rate | 30.7% |

| Separate wage growth and interest rates | 65.6% |

| Other (please elaborate) | 3.8% |

Although a minority of the surveyed practitioners are using it, a net discount rate generally provides a 1% discount rate in recent years for future damages, as demonstrated in the following related question and response:

“Assume the judge instructs that you MUST estimate a net discount rate (and use a fixed rate) in your forecast of total compensation for a 30-year period. The net discount rate may be based upon either nominal or real values. Please note that for this question the net discount rate is (approximately) equal to the interest rate minus the general rate of increase in total compensation for all U.S. workers. Complete the following sentence: “I would use _____% per year as the average net discount rate over 30 future years.”

Results of the 2003, 2009, 2012, 2015, and 2017 (current survey), are provided in the following table:

|

2003 |

2009 |

2012 |

2015 |

2017 |

|

|

Mean |

1.89% |

1.76% |

1.61% |

1.36% |

0.98% |

|

Median |

2.00% |

1.75% |

1.50% |

1.25% |

1.00% |

For the most current survey, the mean and median was 0.98% and 1.00% respectively. The minimum value was -3.60% and the maximum value was 4.00%. Approximately 20% of respondents thought the net discount rate was 0% or less (recall that the total offset rule dictates a net discount rate of 0% may be mandated by jurisdiction). The table above suggests a consistent declining trend in the net discount rate since at least 2003. Much of this decline is likely associated with the decline in U.S. government securities rates since the 2009 recession, as many damage experts simply apply those rates in lost earnings matters.

Approximately two-thirds of respondent use something other than a net discount rate for a thirty- year future damage period. However, additional survey responses do not provide a dominant answer as to which interest rates are applied for present value:

When determining the interest rate for present value purposes over 30 years, I generally use (select one):

| The current interest rate on a particular financial instrument | 16.5% |

| A ladder of yields based on the current yield curve | 23.6% |

| Some historical average of interest rates | 28.0% |

| Forecast of interest rates | 5.5% |

| A combination of current and historical rates | 12.1% |

| Some other method (please explain) | 14.3% |

The following follow-up question was posed:

If you selected “some historical average of interest rates” for [the above question], which of the following best reflect how you choose the number of years to be averaged:

| Historical period equal to the number of years of expected worklife | 35.1% |

| Historical period independent of expected worklife | 64.9% |

Similarly, the terms of the maturity of securities used in selecting the interest rates varies:

“Assume that an injured worker has 30 additional years of worklife expectancy. Regardless of your mix of government securities versus other securities that you might consider, what is the maturity of securities that you would emphasize in selecting an interest rate(s)?”

| Short-term (one year or less) | 9.4% |

| Intermediate-term (two to ten years) | 17.7% |

| Long-term (greater than ten years) | 27.1% |

| A ladder of maturities matching the effective yield curve | 29.8% |

| Mixed | 7.7% |

| Other (please elaborate) | 8.3% |

The JFE survey articles (since 1999), indicate that approximately two-thirds of survey respondents’ earnings related to forensic economics were derived from plaintiff-side work. However, the surveys’ published results do not allow analysis of the correlation between discount rates employed and plaintiff versus defendant work.

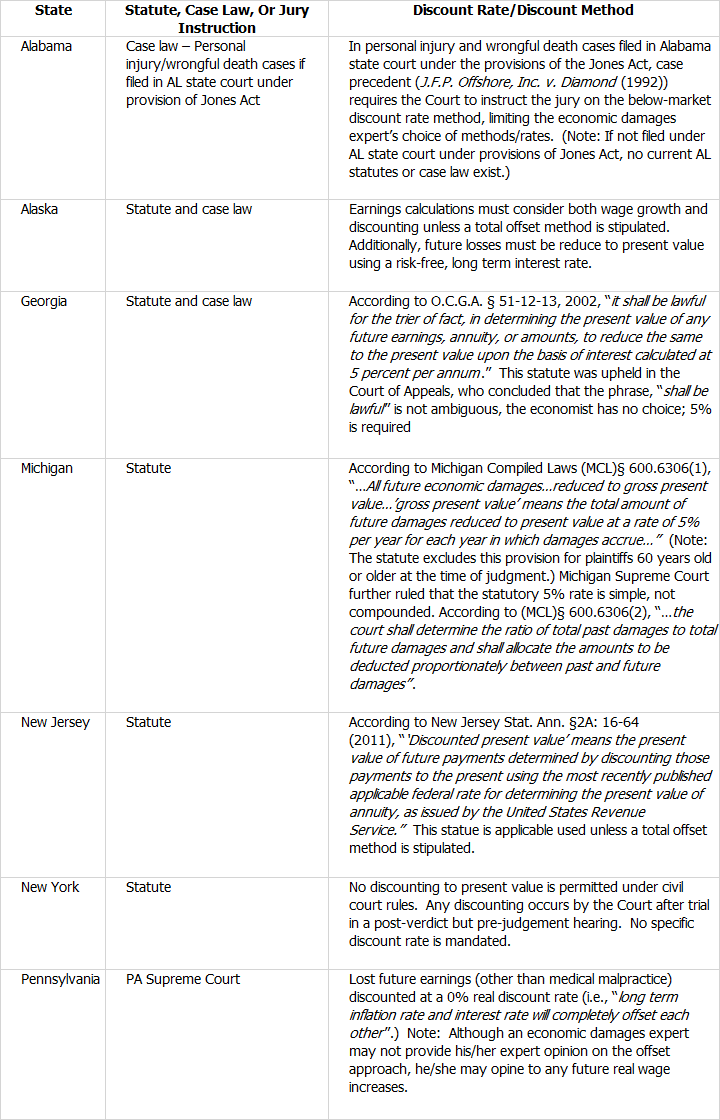

Regardless of the above responses, some jurisdictions mandate a method/rate, either by statute, case law, or jury instructions. The following table provides some examples (related to personal injury claims unless otherwise noted):

However, many damage experts apply a fixed, risk-free rate even when the jurisdiction allows them to use their own expert judgment. For instance, California law requires that damages be awarded at present value, but does not dictate a rate. Section 3904 of the California Civil Jury Instructions (CACI), entitled “Present Cash Value” follows:

“If you decide that [name of plaintiff‘s harm includes future economic damages for [loss of earnings/future medical expenses/ lost profits/[insert other economic damages]], then the amount of those future damages must be reduced to their present cash value. This is necessary because money received now will, through investment, grow to a larger amount in the future.

To find present cash value, you must determine the amount of money that, if reasonably invested today, will provide [name of plaintiff] with the amount of [his/her/its] future damages.

You may consider expert testimony in determining the present cash value of future [economic] damages.”

In many instances, a risk-free government securities method/rate may be economically irrational. “Sources and Authority” of CACI 3904 provides additional guidance on the investment approach that underlies the selection of the discount rate:

“Exact actuarial computation should result in a lump-sum, present-value award which if prudently invested will provide the beneficiaries with an investment return allowing them to regularly withdraw matching support money so that, by reinvesting the surplus earnings during the earlier years of the expected support period, they may maintain the anticipated future support level throughout the period and, upon the last withdrawal, have depleted both principal and interest.” (Canavin v. Pacific Southwest Airlines (1983) 148 Cal.App.3d 512, 521 [196 Cal.Rptr. 82])

Applying a risk-free rate does not typically follow these California legal instructions. In cases with longer damage periods, no competent investment advisor would invest 100% of anyone’s long-term portfolio solely in risk-free investments. Instead, a proper investment approach matches the time horizon for the investment with the underlying use of the moneys being invested. The use of U.S. government securities may be appropriate for damage periods that are only a few years from the date of trial. If the lost income period is 30 years, then one should be investing moneys with a 30-year time horizon (and thereby discounting them to present value accordingly). Application of a risk-free rate over this length of time provides an impermissible windfall to a Plaintiff.

Fulcrum Inquiry performs economic analysis of injury and employment damages.