Updated February 2021

When calculating damages covering future periods, the future amounts must be reduced to present value to account for the time value of money. In many cases, economic damage calculations in personal injury, wrongful death, and employment cases use discount rates that are too low. Consequently, the calculated damages pertaining to future periods are too high.

In some states, statutes provide specific instructions as to the discount rate to be used (see for example The Appropriate Discount Rate in a Lost Earnings Claim). In other states, economic conditions dictate how the discount rate is to be selected. For example, in California, Section 3904A of the California Civil Jury Instructions (CACI), entitled “Present Cash Value” follows:

“If you decide that [name of plaintiff]’s harm includes future economic damages for [loss of earnings/future medical expenses/ lost profits/[insert other economic damages]], then you must reduce the amount of those future damages to their present cash value…. This is because money received now will, through investment, grow to a larger amount in the future.

Further, the section “Sources and Authority” of CACI 3904A provides additional guidance on the investment approach that underlies the selection of the discount rate including the following:

- “The present value of a gross award of future damages is that sum of money prudently invested at the time of judgment which will return, over the period the future damages are incurred, the gross amount of the award. ‘The concept of present value recognizes that money received after a given period is worth less than the same amount received today. This is the case in part because money received today can be used to generate additional value in the interim.’ The present value of an award of future damages will vary depending on the gross amount of the award, and the timing and amount of the individual payments.” (Holt v. Regents of the University of California (1999) 73 Cal.App.4th 871, 878 [86 Cal.Rptr.2d 752])

- “Exact actuarial computation should result in a lump-sum, present-value award which if prudently invested will provide the beneficiaries with an investment return allowing them to regularly withdraw matching support money so that, by reinvesting the surplus earnings during the earlier years of the expected support period, they may maintain the anticipated future support level throughout the period and, upon the last withdrawal, have depleted both principal and interest.” (Canavin v. Pacific Southwest Airlines (1983) 148 Cal.App.3d 512, 521 [196 Cal.Rptr. 82])

When performing these calculations, many economists use U.S. government securities, which are widely viewed as being risk-free. Yet, with long future damage periods, few (if any) competent investment advisors would invest 100% of anyone’s long-term portfolio in this way. Instead, a proper investment approach matches the time horizon for the investment with the underlying use of the moneys being invested. The use of U.S. government securities may be appropriate for (but generally only for) damage periods that are just a few years from the date of trial.

Stated otherwise, if the injured party is being compensated for a long-term injury, the investment time horizon is as long as the compensated injury. This is precisely what the above quote from Canavin v. Pacific Southwest Airlines describes. For example, if one’s lost income is estimated to last 30 years, then one should be investing moneys with a 30-year time horizon. As discussed below, historical investment returns instruct us as to what investment returns are reasonable, and what securities would reasonably be expected to achieve such results.

Experts using risk-free and/or short-term rates for longer investment holding periods typically provide no rational justification for doing so, other than (i) an unsubstantiated claim that the law requires this, or (ii) it is “fair” to do so because the plaintiffs should not be forced to invest in risky assets. These claimed justifications ignore that an economic damage analysis is supposed to fully compensate the plaintiff for his injury. A too-high discount rate lowers damages in a manner that under-compensates the plaintiff. Similarly, a too-low discount rate provides an impermissible windfall to the successful plaintiff.

Although it is always difficult to predict the financial future, the best method available in most circumstances involves the intelligent use of past data and the lessons that such data provides. Such analysis of the financial markets makes the following lessons apparent:

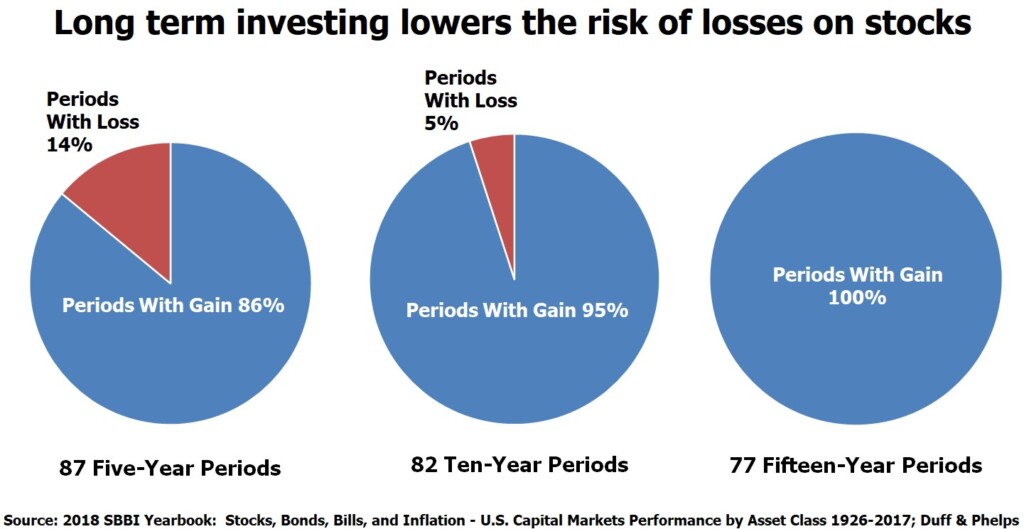

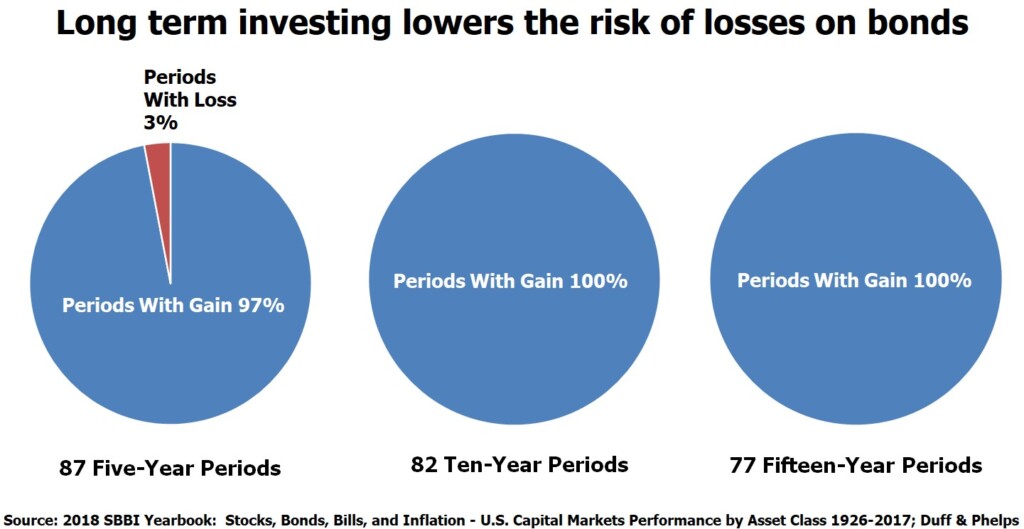

- Over all holding periods, bonds have fewer loss periods than stocks. This is the conventional wisdom. Importantly, for longer holding periods (i.e., more than a 15-year period), there are no loss periods for stocks or bonds.

- Although a bond portfolio faced fewer loss periods, the bond portfolio generally significantly underperformed stock returns. This comment also describes the conventional wisdom. Based on the past over 90 years of market history, stocks have outperformed bonds roughly:

-

- 7 out of every 10 rolling 5-year periods;

- 8 out of every 10 rolling 10-year periods;

- 9 out of every 10 rolling 20-year periods; and

- 10 out of every 10 rolling 30-year periods.

- With a holding period of more than ten years, the only time when stocks incurred a long-term loss occurred because of the stock declines during Great Depression. With a longer holding period, stocks are not nearly as risky an investment as some damages analysts would lead one to believe.

The bottom line of the above is that the damage analyst should create a conservative model portfolio and identify historical investment results that would have been achieved with that conservative portfolio. The rate of return actually earned in the past is the proper basis for a discount rate over a similarly long period in the future. Such a discount rate should be used for longer-term periods over which the plaintiff is being compensated. Short-term compensation periods should use an investment that does not face principle fluctuations.

The instructions contained herein do NOT apply to business or commercial damage calculations. Calculations involving business lost profits should be calculated based on the riskiness of the lost profits that are being discounted. There are a number of well-established methods of determining discount rates for businesses, but these methods are based on different concepts than discussed above.

Fulcrum Inquiry performs economic analysis on commercial damage, injury and employment damages, business valuation, and forensic accounting services.